BBiA Market Update 2021

Production News

Many compostable polymer producers are going through supply chain issues common to the plastics and paper industries – shortages of primary raw materials; problems with deliveries; new rules between the EU and UK on trade; demand exceeding supply capacity. We are seeing a significant volume of raw materials sucked into India, the USA, and China as a result of policies promoting the use of compostable materials.

At the same time, policy uncertainty in the EU and UK has hindered the development of new production capacity. Despite this, the

Total-Corbion plant in France is under construction, leading to another 100KT capacity annually of PLA, as well as the Thai

Natureworks plant, which is expected to produce circa 75KT of PLA – official planning permission was granted this summer.

The UK is importing more or less all of its compostable polymers,

Ingevity in Runcorn being the largest industrial UK producer, along with other BBIA members like Biome and Futamura also manufacturing on these shores. Compounding capacity in the UK is also currently very small. The global market pull for compostables is so strong that this represents a major opportunity for the UK chemical industry, both for the domestic and export markets, that is largely overlooked by policymakers.

Sustainability News

Concern over the use of PFAS-containing substances in all spheres is increasing – it is commonly used legally in applications that require moisture and grease barriers, largely catering ware. Due to the environmental and health concerns over PFAS, European Bioplastics, which owns the seedling logo widely used to identify compostables, will now

no longer allow the use of their logo on any products containing PFAS. This strongly signals to the marketplace that these substances are no longer acceptable.

The use of new raw materials in manufacturing

was hailed by UK Prime Minister Boris Johnson as a necessary route to reduce plastic waste. The UK is a leader in start-ups using innovative raw materials to make products typically made from plastic – these include fungi, seaweed, straw, starch, sugars, cellulose, bagasse, wool, pineapple waste, coconut waste, food manufacturing by-products and more. Whilst most of these industries are still very small scale, the potential for growth is significant and, given the right policy measures, achievable quickly. The advantages in terms of sustainability include lower GHG footprint

in production phases, use of materials that would otherwise often have become wastes, and products being easy to recycle through composting, returning their carbon to the soil.

Product News

UK producer

BIOME has announced that, following the interesting results for its tests on biodegradable tree guards, its products have now gone into commercial production. These reduce plastic contamination by biodegrading naturally into soils as they degrade over time, whilst fulfilling their role of protecting newly planted saplings.

UK producer

FLOREON has announced the launch of its halogen-free flame retardant bioplastic, a high-performance alternative to flame retardant ABS. The halogen-free bioplastic, derived from plants, is suitable for chemical and mechanical recycling and has up to a seven times lower carbon footprint than oil-based plastic, making it a safe and sustainable option for electrical goods.

UK producer PLANGLOW has updated its range of compostable packaging materials available on the marketplace with packaging made for various events, locations and uses.

UK manufacturer PARKSIDE FLEXIBLE announced last month that it has worked with the chocolate company DIRTY COW

to move to compostable flexible packaging.

UK butcher Westaway has

replaced plastic cling film with compostable material. Owner Charles Baughan says, "There are over 400 million packs of meat products sold in the U.K. every year packed in plastic trays wrapped in films that cannot be easily recycled. I hope this ground-breaking innovation by our small team will challenge the whole sector. Here in South West England, we live in a wonderful part of the world, and we know that packaging does not always end up where it should. We feel strongly that doing nothing is not an option." In April of 2020, Westaway replaced the cling film with a three-layer blown coextrusion from Fabbri Group called Nature Fresh that is certified as compostable according to the EN 13432 Standard in both home and industrial settings. “We are the first ones in the world using Nature Fresh for meat products,” notes Baughan. He also proudly adds that the package was named Innovation of the Year in the U.K. Packaging Awards 2020 sponsored by Packaging News magazine.

UK supermarket chain LIDL

has announced that from January 2022 it will be supplying only compostable fruit and vegetable bags in its UK stores, advising customers to re-use these as food waste bin liners. This follows a similar rollout from Waitrose on the F&V bags, as well as Aldi and Co-op on their compostable carrier bags. The more instruments citizens have to collect food waste cleanly, the more food waste we will get delivered to treatment and back to soil without plastic pollution.

Collection News

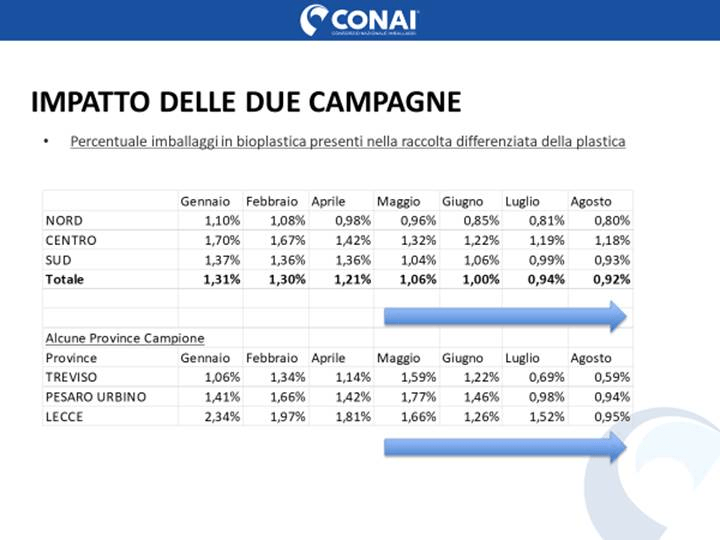

Italy is the EU’s largest marketplace for compostables with volumes exceeding 120KT in 2020, two-thirds of which are films – carrier bags, bin liners, fruit and vegetable bags. One fear of the waste and plastics industry is that compostables will contaminate plastic recycling streams, so the national packaging consortium (CONAI) undertook analyses across the country, which they presented this month. The results can be seen in the graphic below entitled “Percentage of bioplastic packaging found in the separate collection of plastics”.

The data is very clear – nationally there is about one per cent contamination of compostables in conventional plastics collected for recycling. Treviso, an area with particularly high levels of recycling (in excess of 80 per cent), shows contamination varying from 0.6 to 1.6 per cent. The decline in contamination levels over the months during which monitoring took place is partly attributed to national advertising and public information campaigns being undertaken by the national media, paid for by the new compostable EPR system BIOREPACK. The BIOREPACK system, established this year, is now beginning to function. Compostable packaging producers and distributors will contribute, in 2021, some €30 million to be spent on supporting the recycling of compostables through the organic waste stream and public education/information.

The one per cent contamination level is far below any threat to the quality of plastic recycling, quantified by CONAI to be between five and ten per cent depending upon the polymer type.

At the same time, plastic contamination of food and garden waste streams was reported this year by CIC, the national consortium responsible for the treatment of food and garden waste in composting and AD plants. CIC reported a national average of 3.1 per cent plastic contamination in 2020, with a cost to the system in extraction and disposal of between €100 and €120 million in 2020 alone. Italian compost and AD plants treated circa five million tons of food and two million tonnes of other wastes in 2020. Plastics contamination of biowaste streams, therefore, exceeds bioplastics contamination of plastic waste streams by 3:1. Sometimes, policymakers have the wrong focus.

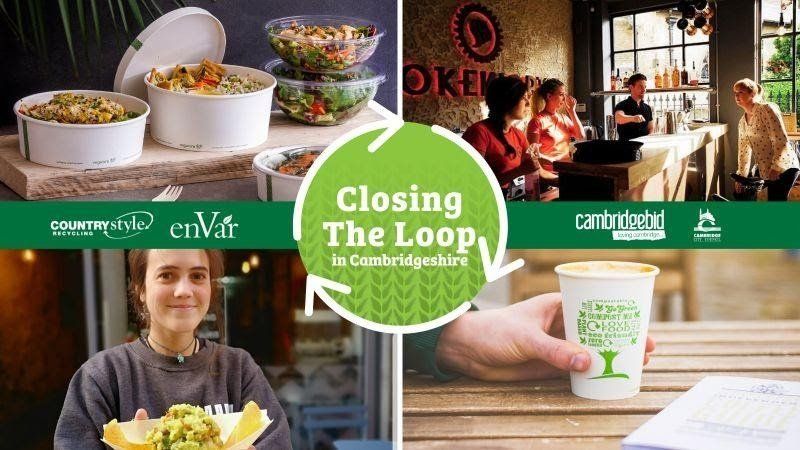

In the UK, we are pleased to announce that ENVAR, in collaboration with Cambridge City Council, has developed what will be (we believe) the UK’s first on the go (street level) food and compostable packaging collection service, as per the Linkedin announcement shown below. ENVAR treats around 130KT of food and garden waste in its Huntingdon plant and another 200KT+ in its other IVC and AD plants around the UK, and has embraced compostables from an early stage, being the reference treatment plant for collections in many UK cities, especially for catering ware waste. Whilst DEFRA is still discussing whether compostables should even be considered 'recyclable' under new collection and EPR rules, ENVAR and Cambridge are showing that they can now, in reality, be collected and recycled. We hope other councils will follow suit – we don’t need to wait upon the Government in order to act.

New Paragraph

Brand News

Market pull for compostables is (as we said above) increasing daily. The paper published by the pressure group A Plastic Planet, entitled

'The Compostable Conundrum', gives guidance to brands, designers, retailers, as well as policymakers, as to when best to use and not to use compostable packaging. It will not be welcomed by all – for some, it is too broad, and for others, too narrow, but the guidance will be widely used to define packaging choices.

The UK Plastic Pact has agreed that all tea bags, plastic coffee pods and bags, and sticky fruit and vegetable labels should be compostable as soon as possible. Just a few examples of major international brands adopting compostable packaging include – Pepsi Cola, which announced its first USA compostable packaging for the Frito-Lay® brand; Unilever and Kraft Heinz, which have confirmed their 2025 goal to 'Ensure that 100 per cent of our plastic packaging is designed to be fully reusable, recyclable or compostable'; Mars Wrigley, which has introduced compostable packaging for its SKITTLES® brand; Lavazza, which has made all of its plastic coffee pods compostable. BBIA sent a list of compostable packaging users in the UK to DEFRA this year, which includes a very large number of major UK brands.